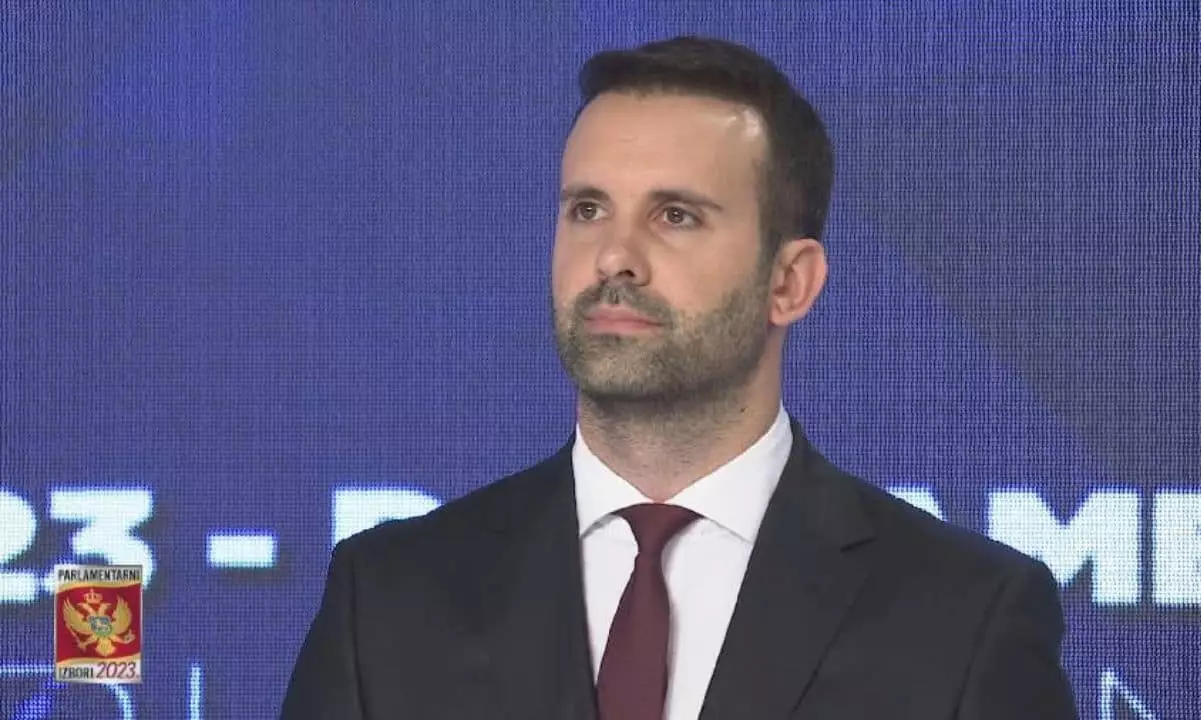

In a recent report, it was revealed that Montenegrin Prime Minister Milojko Spajić was among the early investors in Terraform Labs. He reportedly invested $75,000 in April 2018, acquiring 750,000 Luna tokens. This investment proved to be quite lucrative initially, with the tokens peaking at a value of $90 million. However, the project ultimately failed in 2022, resulting in losses exceeding $40 billion for investors worldwide.

Spajić entered into a contract with Terraform Labs on the first day of fundraising in 2018, acquiring Luna tokens at a significantly low price of $0.10 each. Despite the high risks associated with early-stage investments, this price was the lowest offered during subsequent funding rounds. A total of 14 individuals and 10 companies contributed approximately $13.75 million to the project’s initial development and research.

The collapse of Terraform’s Luna token in spring 2022 saw its value plummet from a peak of $119 to nearly zero, resulting in significant losses for investors. While Spajić maintained that it was his employer, not him personally, who was defrauded of the investment, financial experts believe that he would have faced losses nearing $90 million if he had retained his tokens through the market’s peak in early 2022. Spajić did not disclose owning Luna tokens to the Agency for the Prevention of Corruption, despite declaring ownership of Bitcoin worth €150,000 in 2020 and 2021 reports.

It remains unclear whether Spajić sought to recover his investment or lost profits from Do Kwon, the founder of Terraform Labs. The company and Kwon have since been held accountable for defrauding investors, with the SEC securing a settlement requiring the payment of $4.37 billion in fines and interest by the company and a $200 million contribution to an investor compensation fund by Kwon. Kwon, who is currently detained in Montenegro, faces extradition to either the United States or South Korea for trial.

The story of Montenegrin Prime Minister Milojko Spajić’s investment in Terraform Labs serves as a cautionary tale about the risks associated with early-stage investments and the importance of due diligence in financial decisions. Despite initial success, the project’s failure and subsequent legal consequences highlight the potential pitfalls of investing in volatile markets and unproven ventures.

Leave a Reply