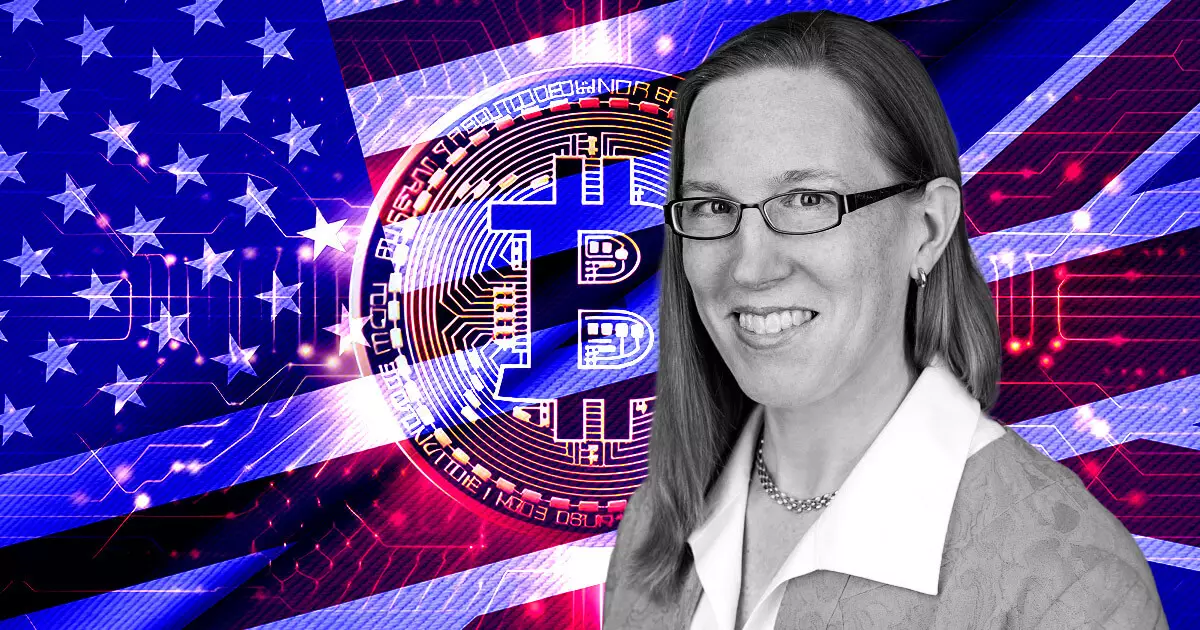

In a recent proposal put forth by SEC commissioner Hester Peirce on May 29, the idea of creating a shared digital securities sandbox between the US and the UK has emerged. This initiative aims to extend the existing digital securities sandbox (DSS) operated jointly by the Bank of England and the Financial Conduct Authority (FCA) to include US firms as well. The proposal suggests that participants in this shared sandbox would be able to conduct various activities under similar regulatory conditions in both countries, with an added information-sharing agreement between the US and the UK.

Participating firms in this shared digital securities sandbox would have the opportunity to operate under self-chosen regulatory conditions. This freedom would enable them to utilize the sandbox environment to build a market case for their products, identify potential design flaws, and address implementation issues while serving real customers. The primary goal of the sandbox is to ascertain whether distributed ledger technology (DLT) can effectively facilitate securities issuance, trading, and settlement without any adverse consequences.

Regulatory Framework

Under this proposed sandbox, the SEC would allow any firm that is not designated as a bad actor to participate. However, the SEC would also establish a list of eligible activities based on public input. Participating firms would typically be allowed to engage in sandbox activities for a period of two years. To apply for participation, firms would need to submit notices and disclose their involvement to the public. The SEC’s Strategic Hub for Innovation and Financial Technology (FinHub) would play a crucial role in helping firms navigate the participation process, including obtaining no-action letters and exemption orders.

Addressing potential objections, commissioner Peirce stated that while allowing firms to choose their own regulatory conditions could raise some concerns, she emphasized that firms would be required to adhere to reasonable conditions. Peirce also highlighted the numerous benefits reported by firms that participated in the FCA sandbox in the UK between 2016 and 2019. These benefits included raising more capital and having a higher survival rate compared to other firms. A 2019 survey showed that regulators in the sandbox expressed overall support for the approach.

From a public perspective, the proposed shared digital securities sandbox could offer consumers access to products that are not readily available to them. By allowing firms to enter the market more swiftly, the program has the potential to enhance consumer choices and market competition. This proposal comes at a time when the SEC is under intense scrutiny and facing criticism under the leadership of chair Gary Gensler. Critics have pointed to various enforcement actions against crypto companies and speculated about the agency’s political motivations regarding spot ETH ETFs.

Commissioner Hester Peirce’s proposal for a shared digital securities sandbox between the US and the UK represents a novel approach to fostering innovation and regulatory cooperation in the securities industry. While the proposal is still a work-in-progress and not an official SEC initiative, it has the potential to provide firms with a valuable testing ground to explore the capabilities of distributed ledger technology. By addressing concerns, promoting innovation, and facilitating information sharing, the shared sandbox could pave the way for more efficient and transparent securities markets in the future.

Leave a Reply