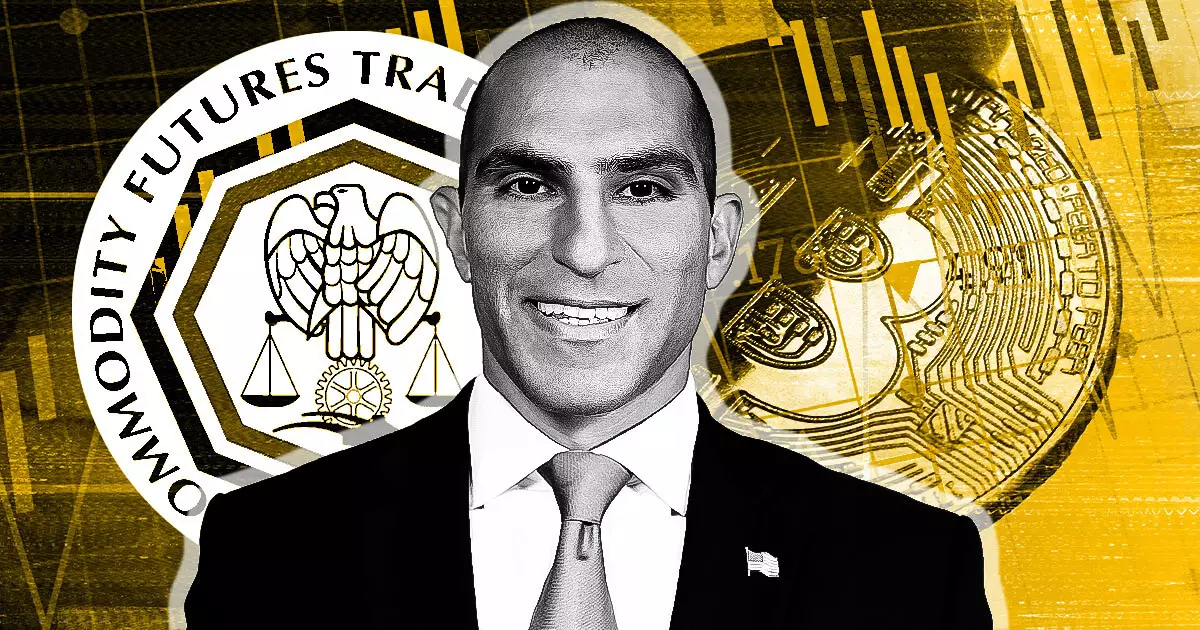

Rostin Behnam, chair of the Commodity Futures Trading Commission (CFTC), recently expressed openness to the idea of the agency serving as a primary regulator for cryptocurrencies. During a Senate Agriculture Committee hearing focused on digital commodities oversight, Behnam discussed the agency’s capacity to take on a more central role in regulating the crypto market. Senator Roger Marshall raised the question of whether it would be beneficial to designate the CFTC as the primary regulator for digital assets, with the Securities and Exchange Commission (SEC) handling only a select few “offshoots.” Behnam indicated that the CFTC is equipped with the expertise and experience to assume this responsibility, although he emphasized the need for changes to definitions of securities and commodities if such a shift were to occur.

Cooperation Between the CFTC and SEC

In response to Marshall’s inquiry regarding the SEC’s role in determining which assets fall under the CFTC’s jurisdiction, Behnam underscored the importance of collaboration between the two agencies. While he expressed reservations about the SEC making unilateral decisions on asset classifications, Behnam acknowledged the long-standing history of cooperation between the CFTC and SEC in resolving regulatory ambiguities. He recognized the potential for lawsuits arising from conflicting asset designations but emphasized the significance of a cohesive framework for listing contracts that aligns with the CFTC’s regulatory authority and facilitates cooperation with the SEC.

Regulatory Framework and Funding

Behnam outlined the CFTC’s objective of introducing tokens and contracts to regulated markets promptly to mitigate investor risks. With a significant portion of the crypto market falling outside the scope of securities regulation, Behnam emphasized the need for robust oversight to safeguard market participants. He highlighted the agency’s budgetary requirements, citing a minimum of $30 million in the first year and $50 million in the second year to establish an effective regulatory regime. Behnam proposed that user fees from registrants could help offset these costs, ensuring adequate resources for staffing, administration, and IT infrastructure. Additionally, he echoed Senator Cory Booker’s concerns regarding the urgency of granting the CFTC increased regulatory authority, warning of continued fraud and market manipulation if decisive action is not taken.

Behnam’s testimony sheds light on the CFTC’s evolving role in regulating cryptocurrencies and digital assets. As the crypto market continues to expand and diversify, the agency faces the challenge of adapting its regulatory framework to address new developments and emerging risks. By advocating for enhanced regulatory powers and emphasizing the importance of collaboration with the SEC, Behnam underscores the need for a comprehensive and proactive approach to overseeing the crypto market. As policymakers deliberate on the appropriate regulatory framework for digital assets, Behnam’s insights offer valuable perspective on the CFTC’s vision for effective and responsive regulation in this rapidly evolving sector.

Leave a Reply