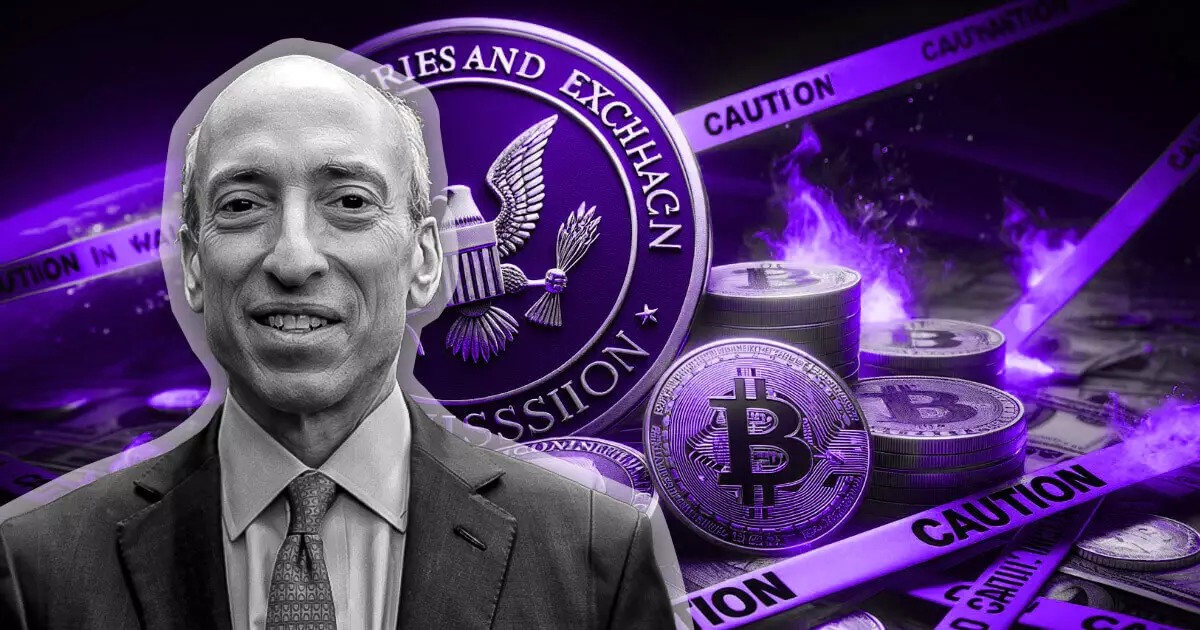

In a recent statement, Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), provided noteworthy clarity on the classification of Bitcoin. In an interview aired on CNBC’s “Squawk Box” on September 26, he reaffirmed that Bitcoin is not deemed a security according to U.S. law. This marks a significant point of distinction as the SEC has navigated a complex regulatory labyrinth involving various cryptocurrencies. Gensler emphasized that both he and former Chair Jay Clayton have consistently maintained that Bitcoin falls under the category of a commodity. The recognition of Bitcoin’s status is crucial, especially as it paves the way for the approval of several spot Bitcoin exchange-traded funds (ETFs), which have now become tradeable on major U.S. exchanges.

While Gensler’s clarifications about Bitcoin are affirmative, his remarks regarding the broader cryptocurrency landscape were noticeably critical. The SEC Chair pointedly criticized numerous cryptocurrency entities for their frequent disregard for established regulations. He expressed concern that a segment of the market appears to operate as though regulations do not apply, which ultimately contributes to instability and confusion within the industry. Gensler stated unequivocally that existing rules are in place and that “many have chosen to ignore them.” This candor reflects a stark reality; for the cryptocurrency market to advance and gain legitimacy, adherence to regulatory frameworks is not just advisable but essential.

In contrast to Bitcoin’s clear status, Ethereum’s regulatory standing remains nebulous. As the second-largest cryptocurrency by market capitalization, Ethereum’s classification is still under debate by the SEC, whose stance has become a source of frustration for lawmakers and stakeholders. Despite ongoing investigations towards companies such as Consensys and Uniswap, which operate on the Ethereum network, the SEC has approved Ethereum-based ETFs. This dichotomy—a simultaneous recognition of Ethereum-based investment vehicles alongside active scrutiny—highlights the inconsistencies within regulatory oversight and underscores the need for a more cohesive approach.

The current state of U.S. crypto regulation has prompted responses from Congress, where several members have criticized Gensler’s tenure at the SEC for fostering ambiguity. By introducing terms like “crypto asset security,” the SEC may inadvertently contribute to the confusion rather than demystifying regulations. Such complexities have drawn ire from both sides of the aisle, suggesting a collective call for improved clarity in regulatory guidelines. Commissioners within the SEC, including voices like Hester Peirce and Mark Uyeda, have echoed this sentiment, suggesting that the agency possesses the tools needed to clarify the regulatory landscape yet has fallen short in doing so.

Looking forward, Gensler projects that the sustainability of the cryptocurrency sector hinges on developing robust regulatory frameworks designed to protect investors and foster trust. He compared the maturation of the crypto market to the evolution of any burgeoning industry, arguing that just as “traffic lights and stop signs” serve to regulate safety and efficiency in transportation, clear guidelines are equally crucial in the financial sector. Ultimately, as Bitcoin enjoys a clear regulatory path, the future of Ethereum and other digital assets remains with an uncertain prospect, demonstrating the need for swift and thoughtful regulatory action to ensure the continued growth and stability of the cryptocurrency landscape.

Leave a Reply