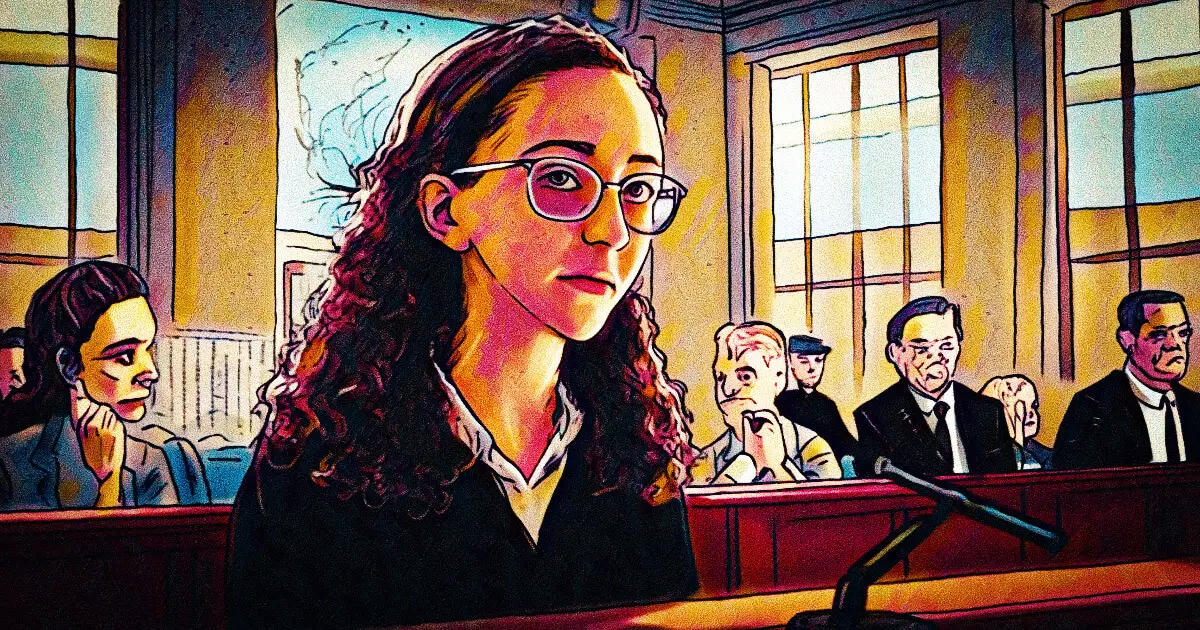

Caroline Ellison, once the prominent CEO of Alameda Research, has recently been sentenced to two years in prison, alongside an order to forfeit a staggering $11 billion. This ruling, handed down on September 24, symbolizes a significant moment in the ongoing legal saga surrounding the collapse of FTX, the cryptocurrency exchange that once held a leading position in the global market. As the former partner of Sam Bankman-Fried (SBF), Ellison’s connection to the crypto industry adds layers of complexity to her case, positioning her at the heart of a scandal that has rocked the financial world.

Ellison’s legal team put forth a robust defense, arguing that her cooperation with federal authorities should warrant leniency. They highlighted her voluntary return to the United States from the Bahamas and her pivotal role in helping to untangle the financial disasters that led to FTX’s downfall. Her testimony during SBF’s trial was deemed essential, characterized as the cornerstone of the prosecution’s case. This raises important questions about the ethical responsibilities of individuals in similar high-stakes environments. Is cooperation enough to absolve one from the consequences of their actions, especially in the face of widespread financial mismanagement?

While her lawyers underscored her previously unblemished record and presented character testimonials to support her integrity, the court’s decision reflects a more nuanced conversation about accountability. Ellison’s claims of being manipulated by SBF resonate with a disturbing trend where individuals may feel coerced into unethical conduct due to the influence of powerful figures. It suggests a broader cultural issue within certain sectors of the finance and tech industries, where ambition and moral ambiguity often collide.

The repercussions of Ellison’s sentencing extend far beyond her personal circumstances. They serve as a cautionary tale regarding the vulnerabilities inherent in the cryptocurrency industry, an environment known for its rapid growth and equally rapid risks. FTX’s dramatic implosion is emblematic of the need for stronger regulatory oversight in a sector often criticized for lacking transparency and accountability. With high-profile figures like SBF facing severe legal consequences, the industry may be spurred towards greater self-regulation and ethical standards.

Furthermore, as more executives from FTX face similar legal scrutiny—including awaited sentences for Nishad Singh and Gary Wang, and the recently sentenced Ryan Salame—the foundations of the cryptocurrency landscape are being tested. Will these legal outcomes influence future practices and governance in crypto firms? The ongoing trials may catalyze a shift, emphasizing the importance of ethical frameworks that govern not only personal conduct but also corporate behavior in this burgeoning market.

Caroline Ellison’s two-year prison sentence is not merely a personal tragedy; it encapsulates broader themes of accountability, ethical leadership, and the vulnerabilities of a rapidly evolving industry. As stakeholders grapple with the fallout from FTX’s downfall, the path toward greater responsibility in the cryptocurrency sector will likely be scrutinized and challenged. The lessons learned from this scandal should serve as a firm reminder of the potential consequences of unethical behavior in the age of digital finance, urging a re-evaluation of values within the industry for a more sustainable future.

Leave a Reply