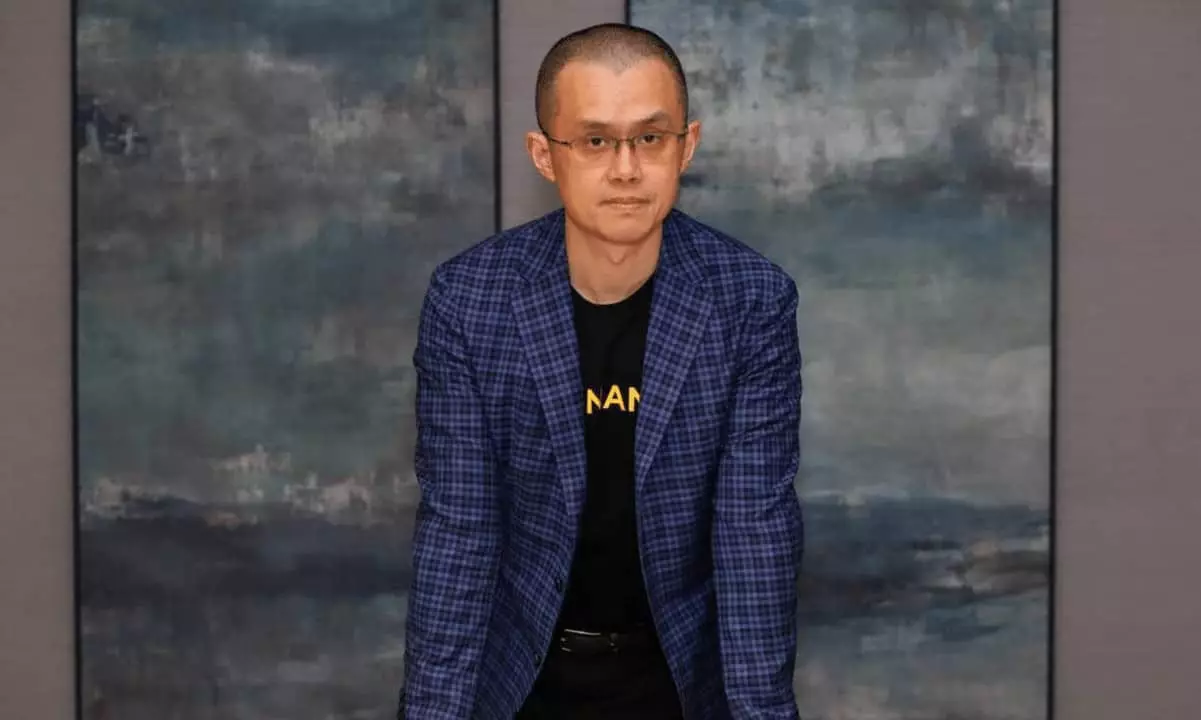

In the ever-evolving landscape of cryptocurrency and blockchain technology, certain endorsements can catalyze significant changes in market trajectories. A recent notable instance occurred when Changpeng Zhao, the former CEO of Binance, publicly endorsed Travala, a blockchain-based travel platform, leading to a meteoric rise in its AVA token. This surge, exceeding 300% within just 24 hours, offers an intriguing case study of how influencer endorsement can leverage market movements, fundamentally altering investor sentiment and behavior.

Several critical developments preceded the endorsement that contributed to the phenomenal increase in the AVA token’s value. Among these factors was Travala’s impressive financial performance announcement, revealing an annual revenue growth from $59.6 million to $100 million within a year. This growth mirrors the increase in consumer interest in utilizing cryptocurrencies for travel-related purchases, an indication of the evolving market dynamics and the growing acceptance of blockchain solutions in everyday transactions.

Furthermore, Travala’s newly unveiled strategy of holding part of its treasury in AVA and Bitcoin echoes practices championed by influential figures like Michael Saylor of MicroStrategy. By taking such strategic financial steps, Travala positions itself as a forward-thinking player in the crypto space, opening avenues for more sustained growth.

Influencer Impact and Market Reactions

The crucial turning point, however, came from Zhao’s December 12 post on social media platform X (formerly known as Twitter). By mentioning Binance’s early investment in Travala, he ignited enthusiasm among investors, thereby amplifying confidence in Travala’s credibility. Zhao, often recognized as a pioneering figure in the crypto community, has considerable sway over market perceptions.

The impact of his endorsement was immediately reflected in trading activity and market metrics. Data from LunarCrush indicated that his tweet garnered over 1.3 million views, translating into an explosive increase in social media engagement surrounding the AVA token. Consequently, the token’s price saw an astounding leap, rising from $0.75 to a peak of $3.38, ultimately stabilizing at around 310% higher than its previous value following the surge.

As the digital landscape of cryptocurrency markets is ever-changing, the AVA token’s recent performance starkly contrasts broader market trends. While a general downturn of 2.20% was recorded across various digital assets, AVA demonstrated remarkable resilience and growth, further reinforcing its position as a standout asset within the Ethereum ecosystem.

Currently, with a trading volume surpassing $890 million—a staggering increase of 28,436%—the AVA token has captivated investor interest. The current market capitalization of around $172 million places it at number 445 in overall rankings, calling attention to its significant, albeit rapid, ascent in the crypto community.

The AVA token’s recent rise serves as a potent reminder of the influence that prominent figures within the cryptocurrency space can exert on market dynamics. As Travala continues to innovate and adapt, its alignment with influential endorsements bodes well for its potential trajectory in a competitive market. Investors and enthusiasts alike will be keenly observing the developments within Travala and the broader implications for blockchain technology in the travel industry, understanding that strategic decisions today may pave the way for the champions of tomorrow in the crypto landscape.

Leave a Reply