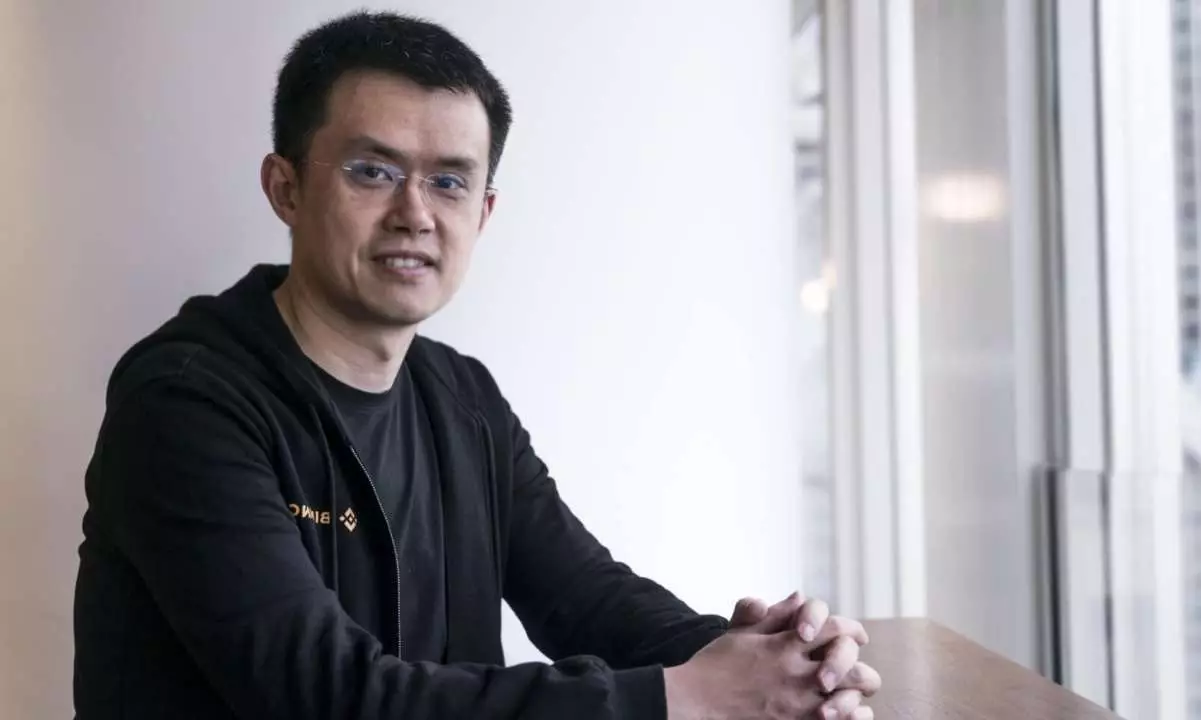

The cryptocurrency landscape has faced numerous challenges, not least of which is the security of digital wallets and exchanges. The recent Bybit hack, which resulted in a staggering loss of nearly $1.5 billion, raised eyebrows across the industry, especially regarding the response from Safe Wallet. The former CEO of Binance, Changpeng Zhao (CZ), publicly criticized Safe Wallet’s post-mortem update on the incident, underscoring the importance of transparency and rigorous security measures in an environment often fraught with deception and vulnerability. This article examines the ramifications of the Bybit hack, the effectiveness of Safe Wallet’s response, and the broader implications for the cryptocurrency ecosystem.

At the heart of the hack lies a breach that extended beyond the immediate infrastructures of trading platforms or wallets. Forensic investigation reveals that compromised credentials from a Safe Wallet developer led to deceptive signings that authorized the malicious transactions. Specifically, attackers exploited vulnerabilities within Safe Wallet’s architecture rather than Bybit’s systems. This distinction is crucial as it underscores the necessity for a robust security framework surrounding development and operations in cryptocurrency.

Upon confirmation of the breach, Safe Wallet pointed to a compromised developer machine as the primary concern, stating that their own smart contracts and source code remained intact and unaffected. Nevertheless, this assertion raised several pertinent questions. Was the vulnerable point an internal flaw, or did it stem from external social engineering tactics? Such ambiguity left many, including CZ, seeking clarity about how the attack unfolded, indicating potential gaps in the security protocol surrounding developer access.

CZ’s condemnation of Safe Wallet’s update highlights a severe concern regarding communication within the cryptocurrency community. His critique emphasized that Safe Wallet’s language was imprecise and did little to provide the clarity that investors and users needed post-incident. By stating that he had “more questions than answers,” CZ echoed a broader sentiment within the cryptocurrency community: that a lack of specificity in response can exacerbate user panic and distrust.

Amidst the chaos, it’s important to underline that effective communication is paramount during a crisis. A transparent dialogue that openly addresses challenges and possible security lapses fosters trust, while vague reassurances leave stakeholders feeling exposed and apprehensive.

The complexity of the attack mechanics further complicates the narrative. Reports indicate that malicious JavaScript code was implanted into Safe Wallet’s Amazon Web Services environment two days prior to the breach. When triggered by transactions from targeted contract addresses—such as that of Bybit’s multi-signature wallet—the malicious code activated, leading to unauthorized approvals of transactions.

This alarming trend points to the sophistication of current hacking techniques, which can circumvent standard verification processes, including Ledger verification methods. The implication of bypassing security checks is a wake-up call for the entire industry, underscoring that security measures must continuously evolve to outstrip the tactics employed by attackers.

In the aftermath of the breach, Bybit took immediate measures to stabilize its operations, including acquiring a loan of 40,000 ETH from Bitget. These recovery efforts indicate a proactive approach to restore user confidence, further evidenced by the successful reinstatement of asset reserves. The commitment to back all client assets is an essential step in reassuring users that their investment remains secure despite external threats.

However, this event serves as a clarion call for the entire industry to prioritize security protocols. The implications of being attacked can resonate widely, affecting not just the targeted entities but also eroding public trust in the cryptocurrency market at large. Vigilant audits, enhanced security measures, and clear communication in times of crisis are no longer optional; they have become indispensable components of operational strategy.

The Bybit hack and the ensuing fallout reveal critical lessons about security, communication, and community resilience in the ever-evolving world of cryptocurrency. As industry players grapple with the complexities of securing digital assets, there’s an essential need for transparent dialogue and rigorous protocols. Safe Wallet’s response, while highlighting important issues, also emphasizes the necessity for clarity and decisive action in the face of impending threats. The path forward involves learning from these hardships, ensuring that both users and providers invest in a future equipped to defend against the next wave of cyber threats.

Leave a Reply