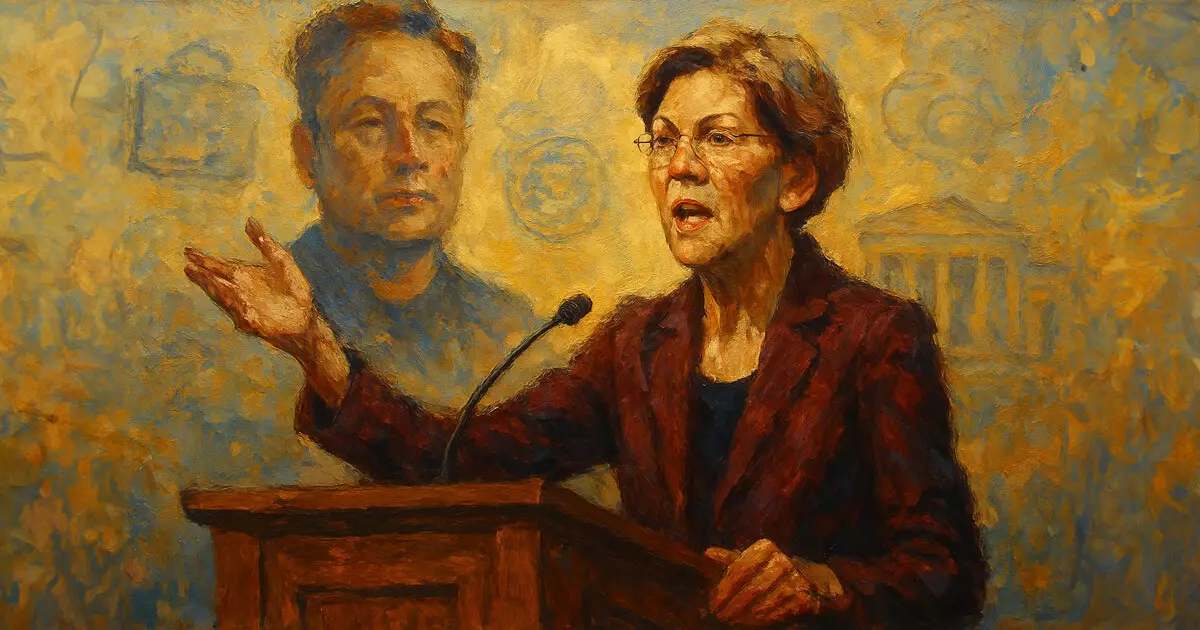

In the midst of increasing scrutiny surrounding government transparency, the introduction of the SEER Act by Senator Elizabeth Warren and her coalition marks a bold step toward ethical governance. The necessity for reform in the realm of Special Government Employees (SGEs) like Elon Musk and David Sacks cannot be overstated. The current system permits part-time federal workers to operate under a veil of ambiguous ethics, enabling potential conflicts of interest that threaten the integrity of our democratic processes.

The glaring inequity lies in the fact that these SGEs can evade strict disclosure requirements that full-time officials must adhere to, thereby allowing influential figures to navigate between corporate interests and government roles without appropriate accountability. This setup creates an ethics quagmire that is politically untenable, especially when the individuals involved have significant financial stakes in private enterprises linked to federal contracts.

Elon Musk: A Case Study in Ethical Conflicts

Let’s take a step back to examine the real implications of allowing someone like Musk to serve in a governmental advisory position while simultaneously being the CEO of a major company. Musk’s financial gains through favorable government contracts put him in a unique position of power—a power that begs for scrutiny. It’s not merely about Musk, but the countless other SGEs who could slip through the cracks, posing potential conflicts that raise legitimate ethical concerns. While Warren and her supporters push for reform, it is imperative to consider the broader ramifications: how many other influential figures are operating in the regulatory murk, shaping policy to their benefit while the public remains in the dark?

The Support Behind the SEER Act

The backing of the SEER Act by a diverse coalition, including watchdog organizations and advocacy groups like Public Citizen and Citizens for Responsibility and Ethics in Washington (CREW), underscores its potential significance in the political landscape. This broad-based support signifies not just a partisan issue but a collective demand for ethical clarity in governance.

Moreover, the elements of the SEER Act that propose prohibiting SGEs from receiving compensation related to their non-government roles after 130 days speak volumes to the desire for limiting undue influence. Introducing strict conflict-of-interest regulations is not just an administrative exercise; it represents a watershed moment in combating the corporatization of government advisory positions. The urgency of the bill reflects a growing public sentiment that demands government accountability, particularly in an age when the intertwining of private and public interests seems ever more pronounced.

The Implications of Enhanced Oversight

If this bill gains traction, the implications would be transformative. Creating a public database of SGEs could elevate levels of transparency that have been sorely lacking. By mandating the Office of Government Ethics to approve conflict-of-interest waivers and ensure public accessibility to these documents, the bill would move accountability from a mere suggestion to a focused requirement.

In addition, requiring enhanced disclosure from SGEs on their financial interests could serve as a deterrent against unethical behavior, pushing those in advisory roles to think twice about their governmental duties versus their corporate loyalties. This reflects a growing realization that the old methods of operating under a shroud of secrecy are incompatible with the needs of a modern democracy.

The SEER Act is not just another piece of legislation; it could redefine the ethical framework of government advisory roles. As the public increasingly demands accountability from its leaders, bills like the SEER Act will be integral in protecting the sanctity of democratic governance against the encroaching influence of corporate greed.

Leave a Reply