In the tumultuous landscape of cryptocurrency, Ethereum stands at a precarious precipice, trading at a critical support level that has captured the attention of both bullish advocates and skeptical investors. As of late, the market for Ethereum and other cryptocurrencies has been heavily influenced by larger global dynamics, specifically the ongoing trade tensions between the United States and China. When political turmoil collides with the volatility inherent in the crypto markets, the consequences can be both alarming and enlightening for investors.

With Ethereum currently hovering around $1,610, it has faced significant pressure after failing to maintain the crucial $2,000 mark—a development which saw a staggering 21% decline from its previous highs. This downturn is symptomatic of broader geopolitical and economic uncertainties, as traders become increasingly hesitant to commit capital in riskier assets. The precariousness of the market has led many to question what it all means for Ethereum’s future trajectory.

The Impact of Global Trade Tensions

Trade wars can trigger widespread market anxiety, and the recent decision by President Donald Trump to implement a 90-day tariff pause—excluding China—acts like a double-edged sword for cryptocurrencies. On one hand, some might argue it momentarily eases tensions; on the other hand, the underlying fears of an extended conflict loom large over the financial spheres. These uncertainties can be exacerbated by increasing global tensions, making it all the more essential for investors to scrutinize market signals closely. It’s hard to ignore how geopolitical factors mesh with individual asset behavior, brewing a cocktail of instability.

As global economic indicators worsen, many may find themselves drawn away from cryptocurrencies, a pattern evidenced by the current elevated volatility and reduced participation in the market. Thus, the backdrop of a precarious trading environment means Ethereum must navigate a series of complicated emotional and market-driven roadblocks.

The Role of Market Valuation Metrics

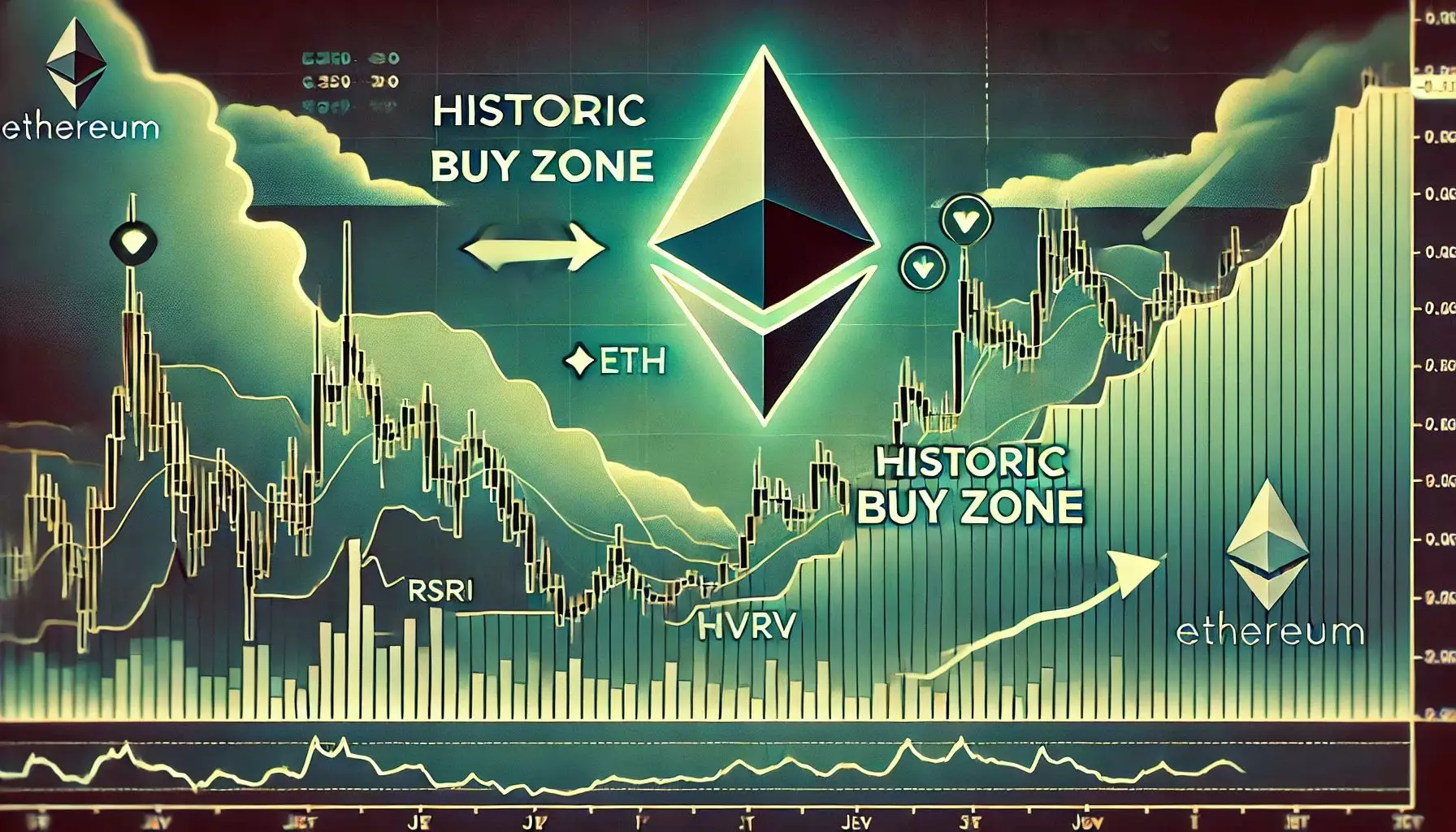

However, there lies a glimmer of hope amid the chaos. Leading crypto analyst, Ali Martinez, has repeatedly pointed to an especially potent historical signal regarding Ethereum’s accumulation pattern. When the price drops below the lower boundary of the Market Value to Realized Value (MVRV) Price Band, it has often signaled an undervaluation that precedes significant rebounds. Presently, Ethereum occupies this critical zone, and for astute investors, this may represent an opportunity cloaked in the guise of despair.

Indeed, if history is any guide, the current positioning carries the potential for upside movement—if, and only if, market conditions stabilize. The crypto markets are notoriously treacherous, yet individuals with sound financial acumen understand the art of looking for value beneath the surface turmoil. Thus, those who maintain a long-term vision could find Ethereum’s present price inadequately reflective of its potential.

The Psychological Barriers at Play

Nonetheless, Ethereum stands poised between a wall and a hard place. Although it remains tethered within a narrow trading range of $1,550 to $1,630, this consolidation period is rife with uncertainty, often serving as a precursor to dramatic shifts. To ascertain whether Ethereum can regain any semblance of momentum, it is critical that it breaks through the psychological thresholds of $1,700 and ultimately $2,000.

Key resistance levels are rooted in both technical structures and investor sentiment. A successful breakout above these figures could ignite fresh buying enthusiasm, potentially setting the stage for a recovery rally. Yet, if bearish sentiment prevails and breaches the existing $1,550 support, Ethereum could rapidly descend towards even lower support levels, thereby fostering a heightened sense of fear and potentially catalyzing a mass sell-off.

Looking to the Future: A Fork in the Road

As Ethereum continues to oscillate amid low volatility, the market is in dire need of a catalyst to prompt directional clarity. Traders and investors alike should brace for continuation in this cycle of uncertainty and emotional volatility until a significant technical or macroeconomic signal emerges. The delicate dance of broken resistance and strong support will dictate who ultimately controls the narrative—bulls or bears.

In this tangled web of fluctuating values and geopolitical strife, one thing is for sure: the road ahead for Ethereum will demand not just data analysis but also keen psychological insight. A currency often heralded as a groundbreaker must navigate through these complexities, or it risks becoming another cautionary tale in an environment already fraught with unprecedented challenges. Investors must remain sharp, discerning, and ready to adapt to circumstances which, while unpredictable, may create avenues previously unseen for those brave enough to seize them.

Leave a Reply