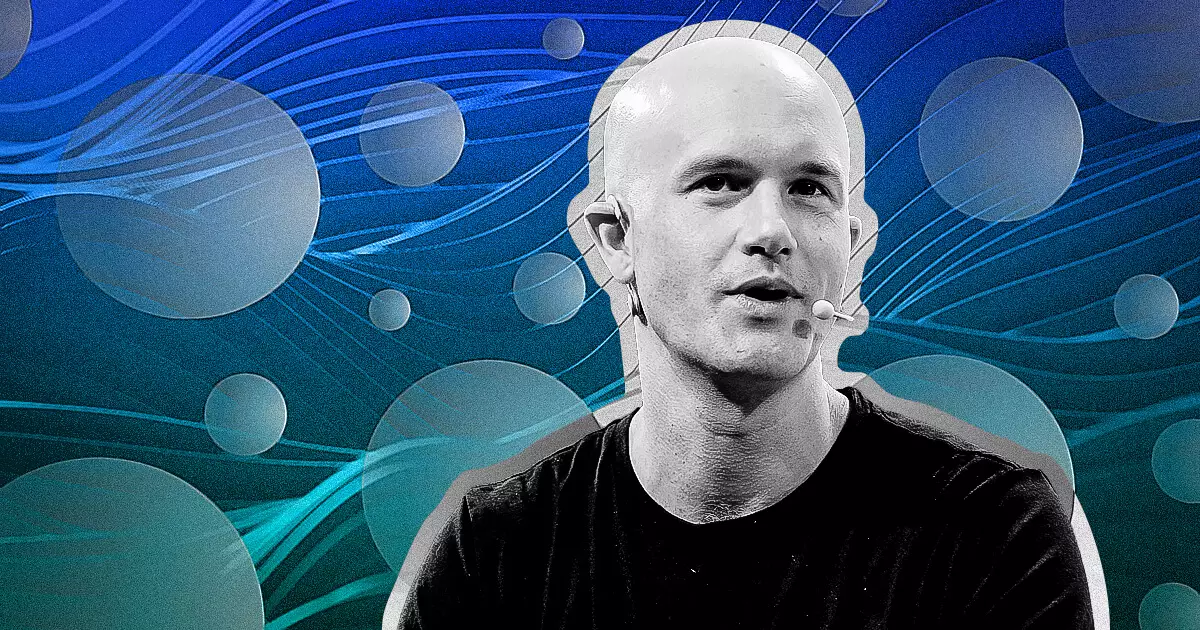

The cryptocurrency landscape has experienced an astonishing transformation in recent years, characterized by exponential growth in the number of new tokens hitting the market. In light of this uprising, Coinbase CEO Brian Armstrong has recently outlined the urgent necessity for reforming the token listing process. His insights, shared through a social media post on January 26, underscore a critical point: traditional assessment methodologies are struggling under the weight of rapid innovation and an influx of new digital assets. With almost 1 million new tokens created each week, the existing approval systems are overwhelmed, revealing a systemic insufficiency that threatens both exchanges and users alike.

These concerns can be traced back to an era when tokens were limited in number and often subject to rigorous evaluations before entering the market. However, advancements in blockchain technology and the emergence of user-friendly platforms have paved the way for virtually anyone to create a token in a matter of minutes. This evolution, although exciting, introduces complexities surrounding the quality and trustworthiness of these new tokens, thereby necessitating a reconsideration of evaluation frameworks.

The Need for a Proactive Approach

Armstrong recognizes the limitations inherent in current token evaluation procedures, which typically require a centralized authority to vet each asset individually. This model, while effective during the early days of cryptocurrency, is no longer viable amid the sheer volume of newly minted tokens. As Armstrong aptly pointed out, this situation represents a “high-quality problem,” yet the reliance on traditional methods is simply not sustainable; evaluating tokens on a one-by-one basis could easily lead to operational gridlock.

To address this challenge, Armstrong advocates for a revolutionary shift towards a block-list system. In this framework, tokens would be categorized based on default accessibility—being available by standard unless marked as potentially harmful. This proactive strategy holds the promise of balancing user empowerment while simultaneously enhancing the scalability of the ecosystem. Relying on user feedback and automated on-chain data analysis, this system aims to create a more agile approach to navigating the burgeoning number of digital assets.

The dialogue around the need for a modernized token listing process naturally intertwines with the discussion surrounding regulatory frameworks. Armstrong’s comments further spotlight the deficiency of established systems designed to manage the dynamic nature of the crypto industry. He implored regulators to reconsider traditional methodologies and foster innovative strategies that can keep pace with technological advancements.

The challenge is monumental: regulators must collaborate with the industry to develop solutions that protect investors while not stifling innovation. Armstrong’s assertion that “the scale of crypto innovation cannot be managed with outdated systems” highlights an essential truth that requires urgent attention. A collaborative effort between public and private sectors is vital for striking a balance between consumer protection and the need for a vibrant innovation ecosystem.

In addition to tackling the systemic issue regarding token listings, Armstrong revealed Coinbase’s plans to integrate decentralized exchange (DEX) support into its platform. The goal is to provide a seamless experience that blurs the lines between centralized and decentralized trading. By enhancing accessibility to both forms of trading, Coinbase aspires to make the decentralized experience intuitive and approachable for the average user.

This shift not only positions Coinbase as a leader in the cryptocurrency exchange arena but could potentially set precedents for how the industry evolves to address future challenges. The key motivation lies in making blockchain interactions user-friendly, thereby inviting a broader audience to engage without hesitation or confusion.

Armstrong’s remarks reflect a broader sentiment resonating throughout the cryptocurrency space: as innovation accelerates, so too must our methods of managing it. The proposed shift to a block-list system, along with regulatory modernization, encapsulates the urgent need for the industry to evolve. The ability to nurture innovation while providing robust protection for investors will be pivotal in defining the future landscape of cryptocurrency. As Coinbase navigates these challenges, its actions will serve as a vital barometer for the industry’s responses to an ever-changing digital economy. Overall, the commitment to transparency, decentralization, and user empowerment must remain at the forefront as we advance into this promising yet complex frontier of technology.

Leave a Reply