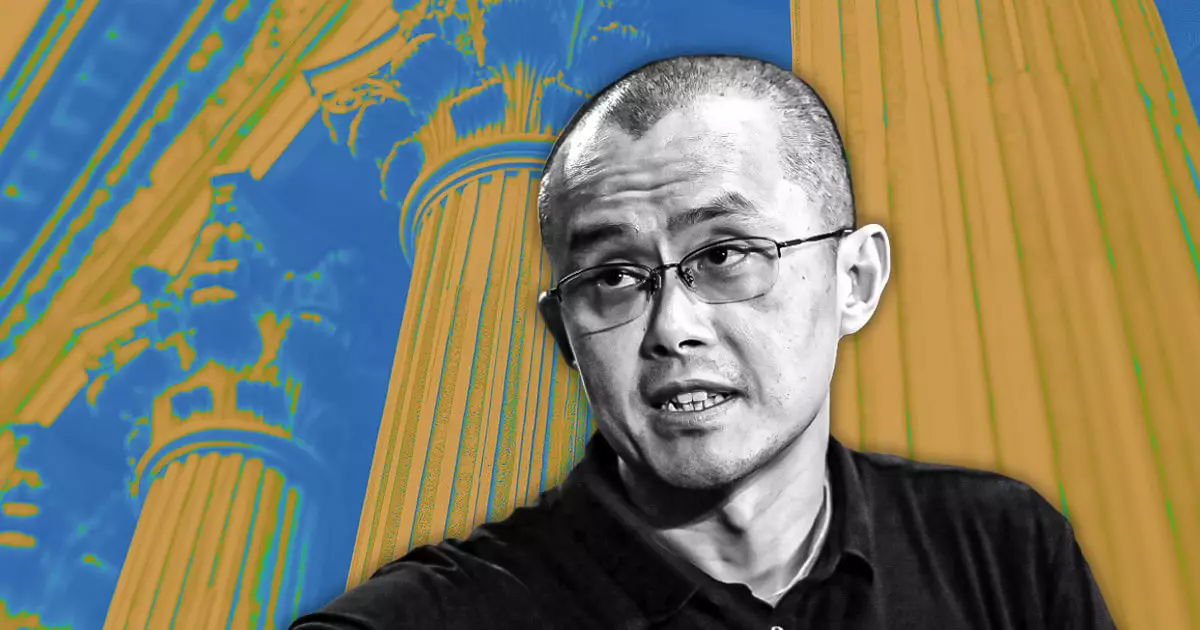

In a recent emergence of rumors, Changpeng Zhao, the founder and former CEO of Binance, took to social media to counter speculation regarding the sale of the leading cryptocurrency exchange. On February 17, Zhao firmly rejected claims that Binance was preparing to be sold to a larger entity, dismissing the buzz as “misinformation” propagated by a competing organization in Asia. This assertion reflects not only Zhao’s commitment to transparency but also highlights the environment of uncertainty that surrounds the cryptocurrency industry.

While Zhao denied any upcoming sale of the entire enterprise, he did signify that Binance might consider allowing external investors to acquire a minority stake in the company at some point in the future. This nuanced approach suggests a willingness to explore partnership opportunities without compromising the foundational independence that has characterized Binance’s operations. Zhao noted, “Top investors have always been interested in Binance,” indicating that the company’s robust reputation still attracts significant interest from potential stakeholders.

Co-founder Yi He further supported this stance, emphasizing that Binance regularly encounters interest from various investors. Despite the persistent rumors, she confirmed that there are no imminent plans to dilute ownership stakes at this time. The importance of maintaining current shareholder integrity cannot be overstated in a market known for its volatility and emerging challenges.

The speculation surrounding Binance’s potential asset sales began when observers noted a marked decrease in the exchange’s cryptocurrency holdings. Many within the community grew concerned, interpreting these shifts as preemptive moves towards an impending sale or an indicator of diminishing financial health. However, Binance swiftly clarified that these transactions were part of a routine treasury accounting adjustment, reassuring users that all assets remain securely backed on a 1:1 basis.

This precautionary statement was crucial in mitigating investor anxiety, particularly in light of a viral post circulating on Chinese social media. The post suggested that Binance’s strategic shift towards decentralized exchanges (DEXs) was fueled by ongoing regulatory challenges, further intensifying speculation around a potential sale.

Despite regulatory pressures and a crowded competitive landscape, Binance stands unshaken as the world’s premier cryptocurrency exchange by trading volume, processing billions in transactions daily. Analysts opine that Zhao’s openness to external investment might be an essential strategy to bolster financial stability while navigating operational independence. Historically, Binance has upheld a private ownership model, but loosening the reins for minority investments could usher in a significant evolution in its corporate structure.

This potential shift opens the door to institutional involvement, thereby presenting greater opportunities for innovation and growth within the cryptocurrency ecosystem. By engaging external investors cautiously, Binance can ensure that its operational autonomy remains intact while also leveraging outside capital for expansion.

As the cryptocurrency landscape continues to evolve, Binance’s responses to rumors and its willingness to adapt could very well define its course in the near future, proving that even giants in the industry must navigate challenges carefully to maintain their stature.

Leave a Reply