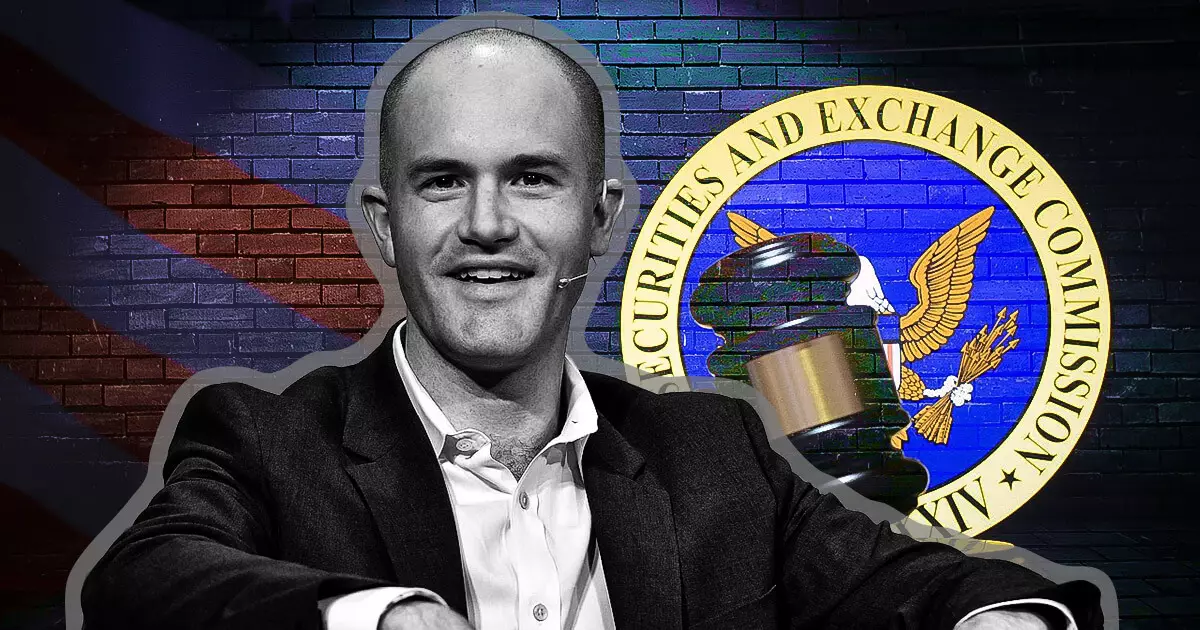

In a striking move that underscores the rift between the cryptocurrency sector and federal regulators, Brian Armstrong, CEO of Coinbase, has declared that the exchange will terminate its relationships with law firms employing former regulatory officials. This decision stems from Armstrong’s assertion that certain regulatory actions taken against the crypto industry were unlawful. In his public announcement on December 3, 2023, he notably pointed to the recent hire of Gurbir S. Grewal, the former Director of the SEC’s Division of Enforcement, by the law firm Milbank, suggesting that such affiliations cannot be condoned.

Armstrong’s message, communicated through social media, reflects a growing sentiment within the cryptocurrency community that regulatory oversight has become excessively punitive. He asserted that law firms must be held accountable for their hiring practices, signaling to his partners that any association with individuals he considers responsible for unethical practices will lead to a loss of business. This bold stance places Armstrong and Coinbase at the forefront of a larger narrative regarding the crypto industry’s struggle to navigate the complex regulatory landscape.

Legal Ramifications and Industry Backlash

The issues Armstrong raised spotlight significant grievances within the cryptocurrency community regarding how the SEC, particularly under the leadership of Gary Gensler, handled enforcement against crypto platforms. Armstrong’s critique suggests not just personal dissatisfaction with the actions of the SEC, but rather a systemic failure to offer clear compliance guidance to companies operating in the space. He has condemned the previous SEC’s enforcement strategy as a departure from acceptable regulatory practices, asserting that there should be a higher standard of accountability for those in power.

The implications of Armstrong’s comments could resonate beyond Coinbase, potentially influencing other firms to reassess their legal partnerships and advocate for a more favorable regulatory environment. By positioning himself as a catalyst for change, Armstrong calls on industry professionals to take a stand against practices that he perceives as detrimental to the growth and innovation within the crypto sector. He encourages stakeholders to actively communicate their positions, effectively making it clear that hiring those who have stood against the interests of cryptocurrency will not be tolerated.

The Ongoing Conflict Between Crypto and Regulators

Coinbase, under Armstrong’s leadership, has continually found itself embroiled in legal disputes as it navigates a shifting regulatory landscape marked by aggressive enforcement tactics. The arrival of Grewal at Milbank illustrates a broader trend of former regulators transitioning into roles within private firms, often focusing on representing clients in the industries they once regulated. This movement raises questions about ethical boundaries and the implications of such transitions, further intensifying the existing conflict between regulatory authorities and the cryptocurrency sector.

Armstrong’s advocacy for clearer regulatory guidelines resonates with many in the industry who seek to promote innovation while ensuring compliance with the law. By refusing to support legal firms that do not align with this vision, he aims to foster a more collaborative future where regulatory constraints do not stifle technological advancements. As this debate continues, the actions of executives like Armstrong are critical in shaping the future relationship between the cryptocurrency industry and regulatory bodies, potentially influencing policy decisions at the highest levels.

Armstrong’s statements serve as both a warning and a rallying cry for the crypto community, urging proactive measures to counteract what he views as unjust regulatory practices, and signifying a pivotal shift in how legal partnerships within the industry may evolve in response to these ongoing tensions.

Leave a Reply