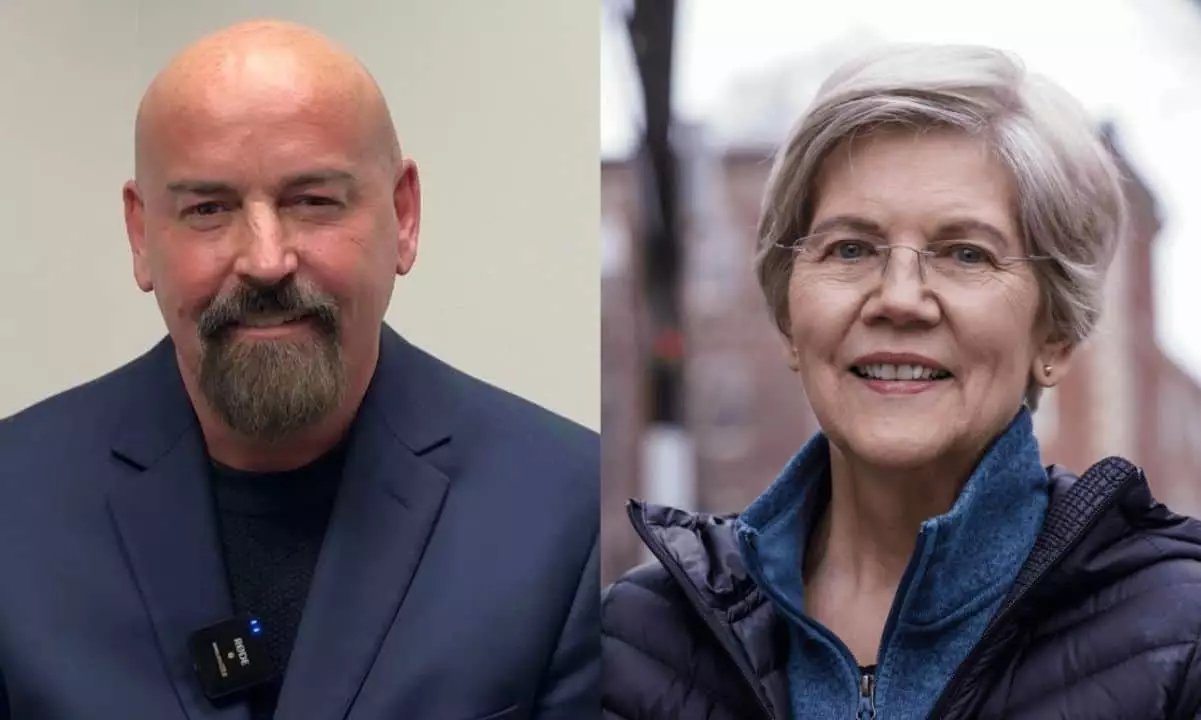

The recent debate between incumbent Massachusetts Senator Elizabeth Warren and her crypto-advocate challenger, John Deaton, has ignited conversations around digital asset regulation, the future of financial independence, and the broader implications for American consumers. This exchange was not merely a battle of facts; it exemplified the growing divide between traditional financial systems and emerging digital currencies, encapsulating larger societal questions about equity, consumer protection, and the role of government in financial affairs.

From the outset, the debate was charged with tension as both candidates articulated sharply contrasting views on cryptocurrencies. Senator Warren emerged from her corner as a vocal critic, intent on highlighting the perceived dangers posed by digital assets. Throughout the debate, she asserted that her focus on cryptocurrencies, particularly as part of her intention to build an “anti-crypto army,” was driven by the need for consumer protection and to mitigate risks associated with financial malpractice. Warren’s stance suggests a belief that cryptocurrencies may facilitate illicit activities and disrupt the existing financial structure meant to safeguard individuals and institutions alike.

In stark contrast, Deaton, a former Marine lawyer turned crypto advocate, presented a narrative depicting cryptocurrencies as valuable tools for marginalized communities. He shared a poignant personal story about how cryptocurrency provided financial relief to his mother, drawing a vivid picture of how digital assets can transform lives and offer alternatives for individuals trapped in a cycle of high banking fees and poor access to traditional financial services. Deaton’s approach centers on the idea that the government has a duty to create an environment where new economic opportunities can flourish, especially for those traditionally left behind by conventional banking systems.

As the debate unfolded, the candidates exchanged serious allegations regarding financial motivations and influence peddling. Warren accused Deaton of being funded disproportionately by the crypto industry, suggesting that should he win a seat in Washington, he would become an advocate for his “crypto buddies” rather than his constituents. This assertion highlights a broader concern about the increasing intersection of political financing and policy-making, particularly where emerging industries are involved.

Deaton countered by highlighting Warren’s past associations with corporate political action committees (PACs), thereby attempting to undermine her credibility on the issue of special interests. He articulated a narrative of regulatory overreach, especially in the context of his involvement in high-profile litigation like the Ripple case, arguing that existing policies are often designed to shield established financial institutions rather than champion consumer rights. Deaton’s rebuttals were strategically positioned to assert that the fight for cryptocurrency is inherently a battle for the economic future of the average American, as opposed to the vested interests of the elite financial class.

Consumer Protection vs. Innovation

A critical aspect of the debate revolved around the balance between protecting consumers and fostering innovation. Warren made her case that regulations are necessary to ensure that cryptocurrencies adhere to the same rules that govern banks and credit unions, aiming to safeguard consumers against potential losses from reckless digital asset trading. However, her critics, embodied in Deaton’s arguments, posited that some regulatory measures could stifle innovation and exclude individuals from accessing the financial freedoms that cryptocurrencies promise.

Deaton’s criticism pointed directly to Warren’s proposals that seemed to favor existing financial institutions over individuals who wish to manage their crypto assets independently. He argued that such stances effectively serve the elite, leaving everyday Americans vulnerable and without viable financial alternatives. This core debate reflects an ongoing struggle within the regulatory landscape—how to create a framework that protects users while simultaneously encouraging the adoption and integration of new technologies into the economy.

The Implications for the Future

Ultimately, the discourse between Senator Warren and John Deaton during this pivotal debate underscores the complexities and nuances involved in the regulation of cryptocurrencies. With the financial landscape continuously evolving, the future of digital assets will likely remain a contentious and polarizing issue. The outcomes of such debates will not only determine the trajectory for digital currencies but could also redefine the relationship between the state and individual economic agency. As policymakers grapple with balancing innovation and security, the voices of constituents advocating for financial freedom through cryptocurrency will undoubtedly become more pronounced in shaping the regulatory framework of tomorrow.

Leave a Reply