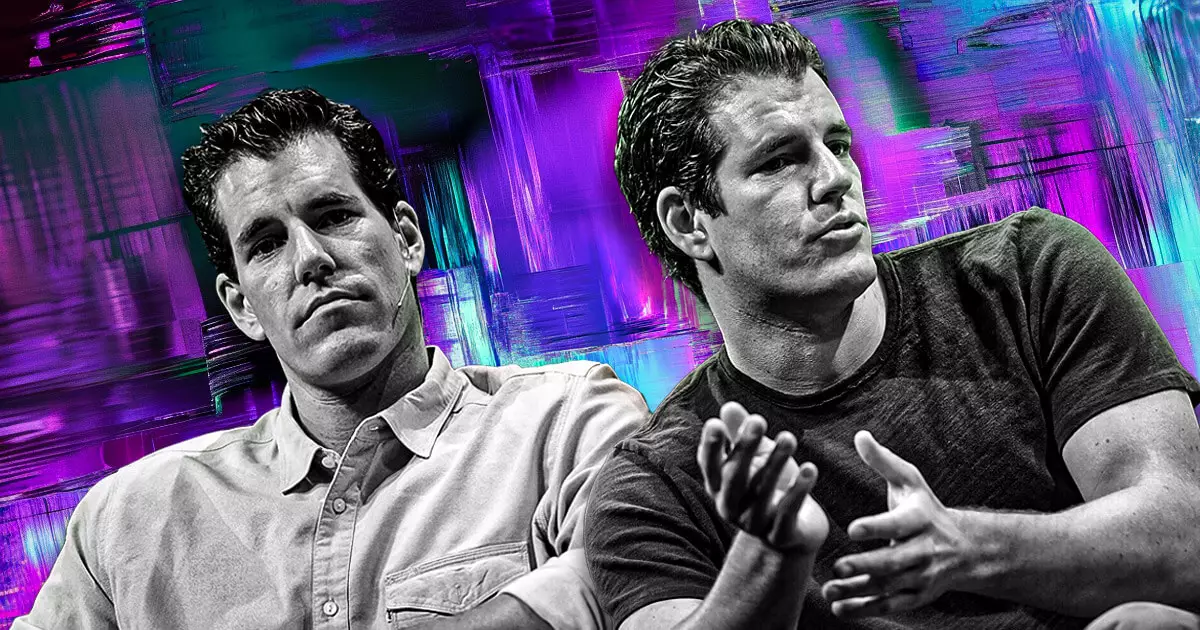

In an unexpected move, cryptocurrency exchange Gemini has publicly declared its decision to refrain from hiring graduates and interns from the Massachusetts Institute of Technology (MIT). This announcement comes as a reaction to MIT’s renewed association with Gary Gensler, the former Chair of the U.S. Securities and Exchange Commission (SEC). Tyler Winklevoss, co-founder of Gemini, voiced his sentiments through social media, emphasizing the company’s stance that any collaboration between MIT and Gensler would disqualify its alumni from employment opportunities at Gemini, including participation in their esteemed internship programs. This decision reflects not only a corporate strategy but also reveals a growing systemic rift between traditional financial regulations and the evolving world of cryptocurrencies.

Cameron Winklevoss, the other co-founder of Gemini, echoed his brother’s sentiments with sharp criticism of the decision by MIT to retain Gensler’s expertise. He characterizes Gensler as a leading figure in public policy failures, suggesting that his previous actions as SEC Chair were detrimental to innovation within the cryptocurrency sector. The Winklevoss twins’ harsh critique of Gensler is emblematic of broader frustrations within the industry. As regulatory pressures mount, many view such figures as impediments to growth and progress in the rapidly developing digital asset landscape.

Gensler’s Return to MIT: Innovations or Restrictions?

While Gensler’s elevation to a Professor of Practice at MIT’s Sloan School of Management may present opportunities for academic exploration into areas such as artificial intelligence and fintech, the implications for the cryptocurrency sector remain fraught with tension. Gensler’s leadership of the FinTechAI@CSAIL initiative signals a commitment to pioneering research, but critics are skeptical, arguing that his historical regulatory stance may discourage innovation rather than inspire it. Industry professionals fear that Gensler’s influence may hinder rather than foster an environment conducive to technological advancement.

Gemini’s decision is not isolated; it reflects broader sentiments across the cryptocurrency landscape. Industry figures like Paradigm co-founder Matt Huang have called upon MIT-affiliated crypto professionals to express their dissent, signaling potential actions that could further distance the crypto ecosystem from conventional regulatory frameworks. Similarly, Caitlin Long, CEO of Custodia Bank, raises the question of whether this trend could mark the beginning of a significant shift. A distancing from institutions that align with regulators perceived to stifle innovation might suggest an industry poised for transformation in its relationship with academia and regulation.

As Gemini galvanizes the crypto industry’s concerns regarding regulatory overreach, the ramifications of its decision may extend beyond mere employment practices. This incident highlights an evolving dialogue between the cryptocurrency sector and institutions seen as emblematic of outdated regulatory models. While academic institutions such as MIT aim to engage with transformative technologies, the challenge will be to reconcile that ambition with the voices advocating for unfettered innovation. The road ahead will require careful navigation, but for Gemini and other voices in the industry, the urgency for change has never been more palpable.

Leave a Reply