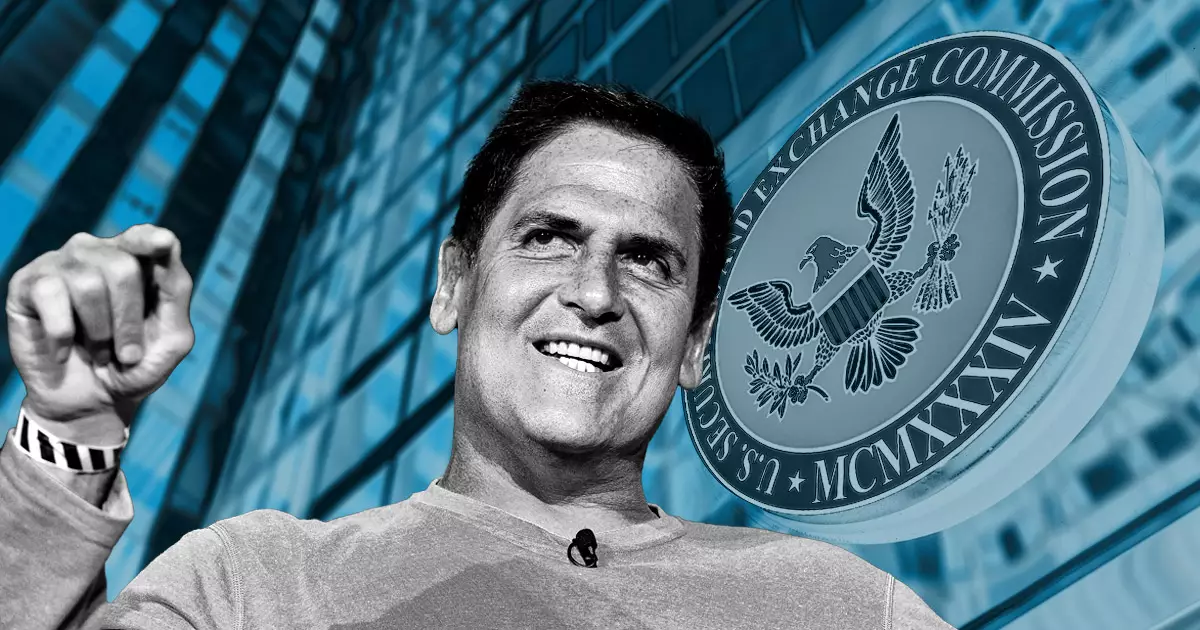

Billionaire investor Mark Cuban has recently made a plea to the US Securities and Exchange Commission (SEC) to update Form S-1 in order to streamline the registration process for token-based companies. This call to action comes after SEC Commissioner Mark Uyeda highlighted the challenges faced by crypto issuers when submitting disclosure filings. Uyeda labeled the current process as “problematic” due to its lack of flexibility in accommodating the unique characteristics of crypto issuers and digital assets.

Form S-1 serves as the mandatory registration statement for domestic issuers looking to offer new securities to the public. The form contains vital information about a company’s operations, risk factors, and product offerings, and is necessary for companies seeking to list their security shares on national exchanges like the New York Stock Exchange. However, Uyeda pointed out that the rigid requirements of Form S-1 may not align with the nature of many crypto issuers and digital assets. This mismatch results in unnecessary information being requested while relevant details are omitted.

In response to these challenges, Uyeda proposed a solution that would allow for variations in Form S-1 filings specifically tailored to crypto digital assets. This approach mirrors existing allowances for funds, insurance products, and other securities, aiming to provide a more efficient and effective registration process for crypto issuers. By customizing the filing requirements, Uyeda believes that companies will be able to provide more meaningful and pertinent information to investors, ultimately enhancing investor protection and compliance with the Securities Act.

Mark Cuban expressed his support for Uyeda’s proposal, emphasizing the need for a more flexible and accommodating registration process for token-based companies. Cuban highlighted the current disconnect between the requirements of Form S-1 and the unique nature of crypto assets, noting that this incongruity has hindered the registration and operation of token-based companies in the market. Similarly, the US Blockchain Association echoed Cuban’s sentiments, praising Uyeda’s proactive engagement with the industry as a step in the right direction.

The push for SEC to modify Form S-1 to better suit the needs of token-based companies reflects the growing recognition of the importance of adapting regulatory frameworks to accommodate the evolving nature of the crypto industry. By addressing the limitations of the current registration process and introducing tailored solutions, the SEC can foster a more conducive environment for crypto issuers while upholding investor protection and regulatory compliance.

Leave a Reply