The cryptocurrency market remains as dynamic as ever, with Bitcoin recently clinching a staggering all-time high of $109,558. This upswing coinciding with President Donald Trump’s inauguration day has turned heads, particularly due to burgeoning discussions around the potential establishment of a Strategic Bitcoin Reserve (SBR) during his administration. This convergence of market movement and political landscape prompts a deeper evaluation of the intertwined relationship between governance and cryptocurrency.

For months, the possibility of a U.S. government-backed Bitcoin reserve has generated whispers within financial circles. These discussions have intensified following predictions and market speculation indicating that an executive order could be signed imminently. Platforms like Polymarket have showcased a marked surge in optimism regarding the creation of such a reserve, with odds skyrocketing to 59% shortly before Bitcoin’s latest price surge. The implications of a strategic reserve would not only affirm Bitcoin’s legitimacy but also set a precedent for cryptocurrencies being viewed as integral components of national economic strategies.

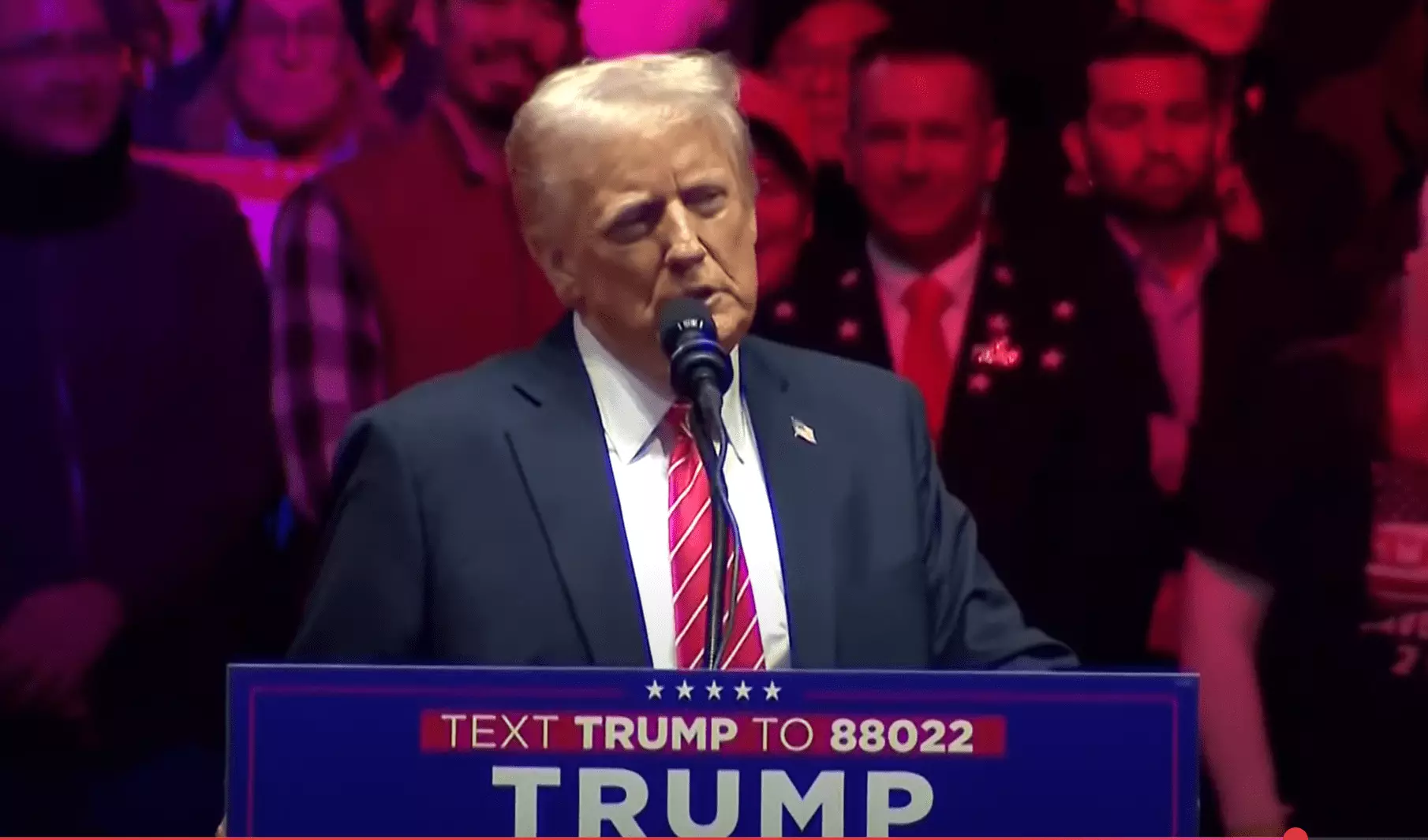

Speculators point to previous comments from Trump concerning the potential use of seized Bitcoin by law enforcement agencies, which could form the backbone of a government-held reserve. As the inauguration day approached, rumors of an executive order being signed to formally initiate the SBR ignited significant market momentum. In a clear demonstration of political engagement with the cryptocurrency space, key figures within both the Bitcoin community and the Trump administration have convened, fostering an atmosphere ripe for legislative action.

Influential Bitcoin advocates have recently met with Trump and his incoming administration, further stoking speculation surrounding the SBR. Senator Cynthia Lummis, a prominent supporter of Bitcoin legislation, has actively pushed for the adoption of a comprehensive digital asset framework. Her proposed “Bitcoin Bill,” which plans to acquire a substantial amount of Bitcoin, highlights the increasing seriousness with which lawmakers are considering cryptocurrencies. Coinciding politics and financial ambitions illustrate the urgent need for legislative clarity in an ever-evolving financial ecosystem.

Trump’s connection with established Bitcoin proponents, like MicroStrategy’s Michael Saylor, underscores a moment in history where political willingness aligns with market potential. Photos shared on social media depicting these meetings suggest that the administration is proactively engaging with crypto advocates to potentially shape future policies. The symbolic nature of these meetings cannot be understated—the implications ripple through both public sentiment and investment psychology, creating a compelling narrative that could drastically shift market dynamics.

The recent movement in Bitcoin’s price trajectory suggests that investors are beginning to take these political dialogues seriously. Market analysts have noted the volatility as a reflection of broader investor sentiment. Charles Edwards of Capriole Investments offers a rigorous analysis: sharp price movements followed by swift rebounds often signal a foundational shift in market trends. His insights advocate for vigilance amidst volatility, suggesting that the momentum behind Bitcoin’s recent rallies may indicate a sustainable bullish trend, fueled by rising institutional interest and supportive political frameworks.

As the dialogue surrounding cryptocurrencies continues, the potential adoption of significant legislation regarding digital assets poses both opportunities and challenges. The immediate reaction of the market to rumors and speculation reflects an environment where news and projected outcomes wield substantial influence. In such a landscape, informed investors must navigate the interplay between political engagement and market performance—a task that requires acute analytical skills and a nuanced understanding of both sectors.

The symbiotic relationship between political action and cryptocurrency markets requires careful observation. With figures like Trump hinting at the creation of a Strategic Bitcoin Reserve, the potential influence of governmental policy on Bitcoin’s future is profound. The cryptocurrency community may find itself at the cusp of unprecedented institutional adoption, transforming Bitcoin’s role from a purely speculative asset to a cornerstone of national economic strategy.

As Bitcoin trades at impressive levels, the intertwining narratives of politics and finance present a unique opportunity to redefine what digital currencies signify in the modern economic vista. Engaging with the political dimensions of cryptocurrency not only deepens market understanding but also prepares investors and enthusiasts for the evolving digital landscape, marked by a growing alignment between the halls of power and blockchain innovation.

Leave a Reply