Throughout December and January, Bitcoin captured widespread attention as it surged past the $100,000 milestone, setting new records. Excitement quickly paralleled the intense volatility that characterized its trading pattern, oscillating between $92,000 and $106,000. However, this remarkable ascent came to a jarring halt when Bitcoin experienced a significant downturn, dropping below the $80,000 mark for the first time. This abrupt decline not only shocked investors but was indicative of broader economic turbulence both within and outside the cryptocurrency realm.

The market turbulence intensified as Bitcoin whales—a term for individuals or entities holding large amounts of cryptocurrency—began liquidating their holdings, which added to the mounting selling pressure. This shift coincided with decreased network activity and a fall in Bitcoin’s hash rate, further signaling bearish sentiments among participants in the crypto space. The declining momentum of Bitcoin is not occurring in isolation; rather, it mirrors a larger trend of investor withdrawal impacting numerous markets, exacerbated by macroeconomic uncertainties stemming from policy changes in Washington.

Wider Economic Context

The economic environment has seen a sharp contraction affecting a diverse range of assets. The NASDAQ Composite, a significant benchmark for technology stocks, dipped by 3.5% during this period. Additionally, gold futures fell by a notable 2.92%. Perhaps most concerning is the recent decline in consumer spending, marking the first drop in two years for the U.S. economy. Given these developments, it seems that Bitcoin’s price struggles are intricately tied to the shifting tides of global economic sentiment, rather than being a reflection of its inherent value.

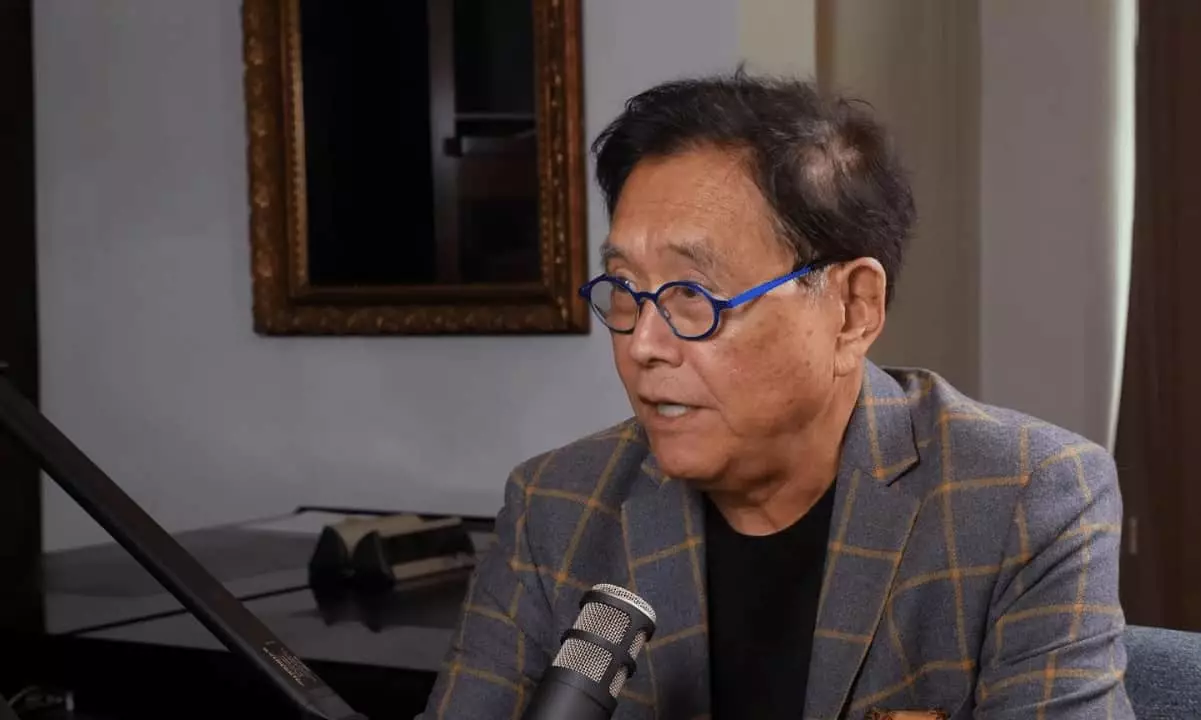

Many market analysts, however, maintain a cautious optimism. Notable investors, including Robert Kiyosaki, author of “Rich Dad, Poor Dad,” have echoed sentiments positing a forthcoming recovery for Bitcoin. This perspective suggests that, despite current volatility, the fundamentals may still support a bullish reversal. Arthur Hayes, the founder of BitMEX, even forecasted a potential “violent wave” down to $80,000 before the market regains equilibrium. Interestingly, Bitcoin did bounce off support at $78,200, ultimately recovering to exceed $86,000—a sign that investors may not have lost faith just yet.

Emerging Investor Behavior

The surge in trading volume accompanying the rapid recovery suggests a resurgence in bullish sentiment among investors. Social media buzz around keywords like “buy the dip” illustrates a growing hunger among retail investors, who might view this as an opportune moment to re-enter the market, tempted by lower prices. Kiyosaki’s assertion that “Bitcoin is on SALE,” further highlights a fundamental belief shared among certain circles that the cryptocurrency continues to be a worthwhile investment despite current fluctuations.

Moreover, Kiyosaki’s critique of the existing monetary system—the reliance on U.S. Treasury bonds and the alarming levels of national debt—underscores a belief in Bitcoin’s long-term viability as a form of sound money. His view reiterates a critical narrative gaining traction among crypto enthusiasts: that Bitcoin represents a hedge against the failings of traditional financial structures. As traders navigate these tumultuous waters, the future of Bitcoin remains uncertain yet compelling, revealing the interplay of fear, confidence, and market dynamics at play in the crypto sphere.

Leave a Reply