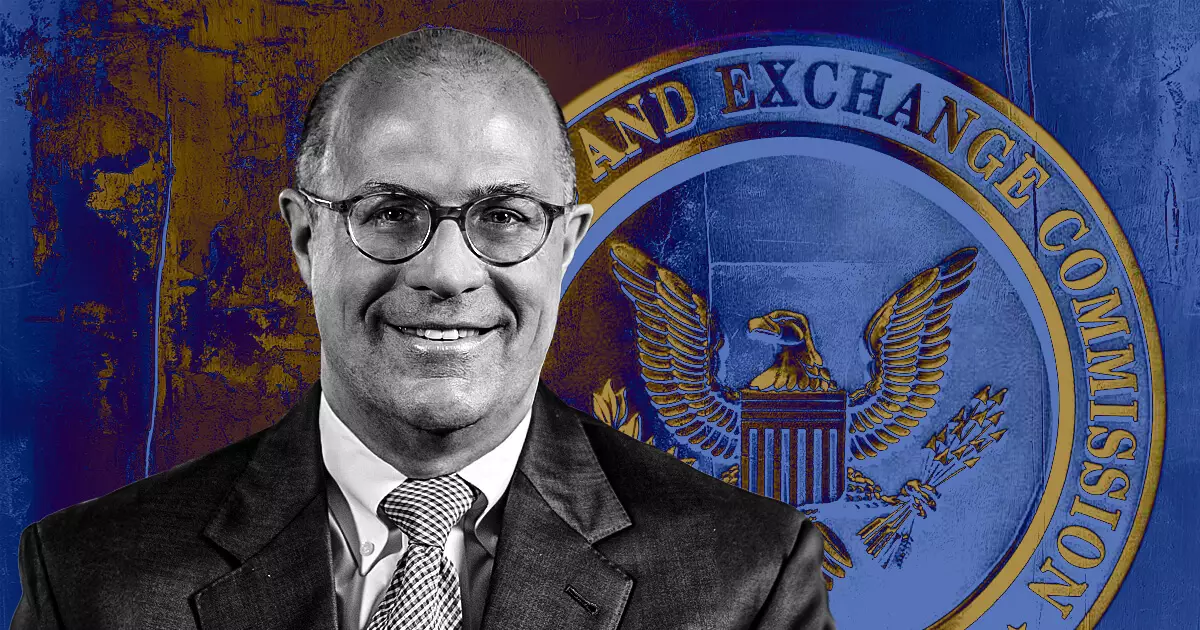

In the complex world of cryptocurrency, regulatory clarity remains a significant issue that impacts investors, firms, and the general perception of digital assets. Former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo, known affectionately as “Crypto Dad” for his pro-crypto stance, has recently found himself at the epicenter of speculation regarding leadership roles within regulatory bodies. Giancarlo’s unequivocal denial of interest in stepping into the role of Chair at the US Securities and Exchange Commission (SEC) reveals a broader narrative about the current fragmentation in policy visions concerning cryptocurrencies. This denial underscores a systematic reluctance among seasoned regulators to return to tumultuous environments characterized by previous regulatory failures.

Giancarlo’s reference to the “mess” left by current SEC Chair Gary Gensler suggests deeper rifts in the regulatory framework applied to the burgeoning crypto sector. His statement reflects frustration over the SEC’s heavy-handed approach to regulation, labeled by some as “regulation by enforcement.” This method not only complicates compliance for firms within the crypto space, but it also raises concerns about the clarity and fairness of rules applied to digital assets. Giancarlo’s decision to step back comes from an awareness of the potential pitfalls associated with managing a sector that is still defining itself against a backdrop of inconsistent regulations and limitations in understanding.

The crux of Giancarlo’s critique lies in the SEC’s aggressive legal actions directed at various crypto firms. Under Gensler’s leadership, the SEC has taken steps to classify a majority of digital tokens as securities, thereby requiring them to adhere to stringent regulations traditionally applied to stocks and other investment products. This rigid approach, while aimed at protecting investors, can stifle innovation and drive businesses overseas to more favorable regulatory environments. Critics argue that this regulatory overreach does little to enhance market integrity and creates an atmosphere of distrust among entrepreneurs and investors alike.

The ongoing friction between regulatory bodies and tech developers was starkly highlighted in Gensler’s recent discussions, where he maintained the importance of vigilance in safeguarding investors’ interests. Others, however, question whether the SEC’s actions have genuinely served that purpose or merely exacerbated instability within the crypto market. High-profile lawsuits against major exchanges such as Binance and Coinbase further accentuate the tense atmosphere, creating uncertainty that deters investment and discourages innovation where it might otherwise flourish.

As both innovation and regulation vie for dominance, the need for a balanced approach has never been clearer. The future of cryptocurrencies will inevitably depend on regulatory bodies that embrace a more nuanced understanding of the dynamic nature of blockchain technology. Giancarlo’s withdrawal from potential leadership roles signals a broader reluctance among former regulators to engage with a system that appears unresolved and uncertain. Addressing these regulatory challenges while fostering a supportive environment for innovators remains one of the most critical endeavors in the evolution of digital assets.

Leave a Reply